The Best Free Excel Budgeting Templates for Personal Finance: You’ve come to the correct place if you’re seeking a practical and easy-to-use Excel template for personal finance or budgeting. Saving money requires taking steps to manage finances and a budget. Managing your finances or budget might be difficult when you have a lot of responsibilities at work and home.

The top 14 Excel templates free are compiled in this article for downloading. Learn how these spreadsheet templates will help you create a safe budget and save more money by reading about them.

What Is a Template for Personal Budget in Excel?

A spreadsheet file is what a personal budget Excel template is. There is no need to spend time formatting since it already contains all columns, rows, headings, formulas, and styles. If you want to keep track of your finances, upload the file to OneDrive.

Using a template, you can format the worksheet design, update the data headers, and add or remove rows and columns. Depending on the level of detail you require, such as a biweekly, monthly, or annual budget, you can obtain a template. You can access the templates in your browser for tracking reasons or download them as Excel files for each of the templates listed below.

Excel Budget Templates on Excel Desktop App:

It is unnecessary to go further for creative and useful Excel budget templates if you are currently using the Excel desktop application. Launch the Excel app when your laptop is connected to the Internet. Once ready, carry out the following steps:

- To view the available Excel templates, look at the right side of this screen.

- The Excel Recent screen should appear after you launch Excel.

- Enter “Budget” and hit the Enter key in the search area.

- For access to the file in its whole view, choose a template from this selection.

- The Excel screen with several budget plans should now appear.

- Click Create if the format is appropriate.

- On the template preview screen, verify the information.

- The template will be updated in Excel.

- Save the template with a distinctive name to OneDrive or local storage by pressing Ctrl + S.

- To alter the template, replace any placeholder text with true brand or household names.

Benefits of Free Excel Templates for Personal Finance and Budget:

Tracking your budget on an Excel spreadsheet has the following benefits:

- Since there are several templates for different budget monitoring situations, these Excel budget templates just need to be slightly adjusted.

- Instead of using another app or manually constructing an Excel template, using an Excel budget template is quicker and more convenient.

- The template typically has headings for transactions, expenses, and budgets. Just regularly enter the numbers to view the interface.

- Spreadsheets in Excel are more secure than using web or mobile apps for tracking and managing a budget.

- For both personal and professional usage, the majority of these Excel budget templates are free.

- Project management Excel templates are reliable and secure because you don’t need to input your finances on a website or app from a third party. There is no need to worry about data theft because you keep your data to yourself.

- Keep a copy of the file on your computer or laptop and upload it to OneDrive so that you may access it whenever you want. Every time a modification is made to the local file, Excel will automatically update the online file. In addition, there is a free Excel mobile app that allows you to access the worksheet on your Android or iOS device.

- If you require Excel budget templates of a professional caliber, Microsoft excel templates or Etsy both sell premium Excel budget planners that can be modified for your company.

Finance Excel Templates on Excel Web:

You might favor using the web version of Excel over the desktop program given the popularity of web applications. In that case, conform to the following steps to access several fascinating budget planners in the Excel web application:

- Make sure that the web browser from which you will access the Excel budget template is signed into your Microsoft Account.

- Now log in to the collection of finance-related Microsoft Office Templates.

- Select an available template and then select Open in Browser.

- The template will be duplicated by the Excel web app and shown in a new tab.

- A Start worksheet is present in the majority of Microsoft templates.

- The characteristics of the Excel template are described in this worksheet.

- Before using the template to manage budgets, review the features and directions.

14 Best Free Personal Finance Excel Templates for Budgeting In 2023:

The 14 free Excel templates for personal budgeting are now available for review.

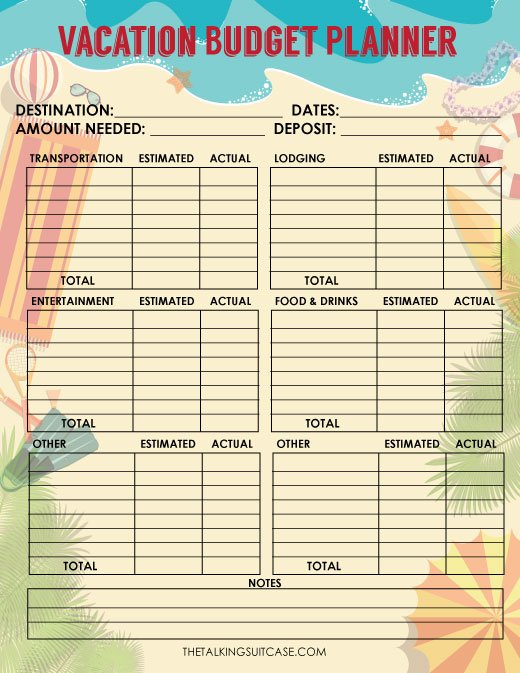

1. Vacation Budget Planner

Make sure you have enough money for your trip and stick to your spending limit by using this simple Excel vacation budget planner. It is essentially a spreadsheet with typical travel spending headers like flight, lodging, and transport.

Two tables are included in this Excel document. The first table lists broad categories including lodging and transportation. The principal expense categories are divided into sections in the second table. Furthermore, you can include special financial outflow headers. It is regarded as one of the top project plan Excel templates for financial planning.

2. Budgeting Calculator Tool

A simple financial tool is a budget calculator. Excel’s desktop application, as well as its online and offline features, are useful for managing monthly costs and income to yahoo finance. The template has cells where the headings for expenses and revenue can be edited. The template is effective for creating monthly budgets. The worksheets should be duplicated for the next month.

The data entry page for income and expense transactions is similar to the manual budget monitoring method of using a notepad. Both capital inflows and outflows may be included in the same list. Enter a description in the Description column and a category in the Category column when creating a new currency outflow header.

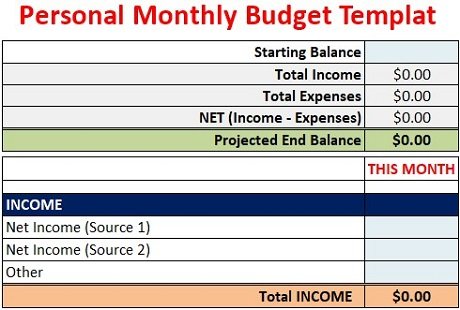

3. Personal Monthly Budget Spreadsheet

If you’re looking for an extensive budgeting template for personal usage, try the Personal monthly budget spreadsheet template. It enables you to spend your monthly money as efficiently as possible while maximizing your savings. The template simply needs a few changes, which makes it very user-friendly.

Most households need to keep track of several spending headers each month, which are included in the smart sheet. For instance, you might allocate money for personal care, pets, food, insurance, hotel, and transportation. Additionally, there are two distinct sources of income, such as primary and secondary sources.

The Excel template also compares projected and actual costs as well as planned and actual profits. Editable subcategories are available in the template in addition to customization possibilities. You can print a copy for offline use and save a copy to your Microsoft OneDrive for online modifications. It is one of the top Excel templates for finance you should take into account in 2023.

4. Personal Basic Budget

Use the Basic personal budget spreadsheet to examine annual income and expense information. For managing expenses for any small endeavor, this personal budget excel templates for project management tool is extremely useful. When you have a good understanding of the annual transactions for the current or previous year, you can spot more cost-cutting options.

The template is freely available to everyone. Both the Excel desktop program and Excel online are compatible with it. The Excel workbook contains two specific Excel worksheets: Summary and Expense. It is recommended to enter all outgoing payments on the Expense tab and all incoming payments on the Summary tab.

The Summary worksheet will automatically display the monthly spending vs cash position app. Standard categories and subcategories for which a budget may be necessary are included in the costs section. The template also enables easy classification and filtering.

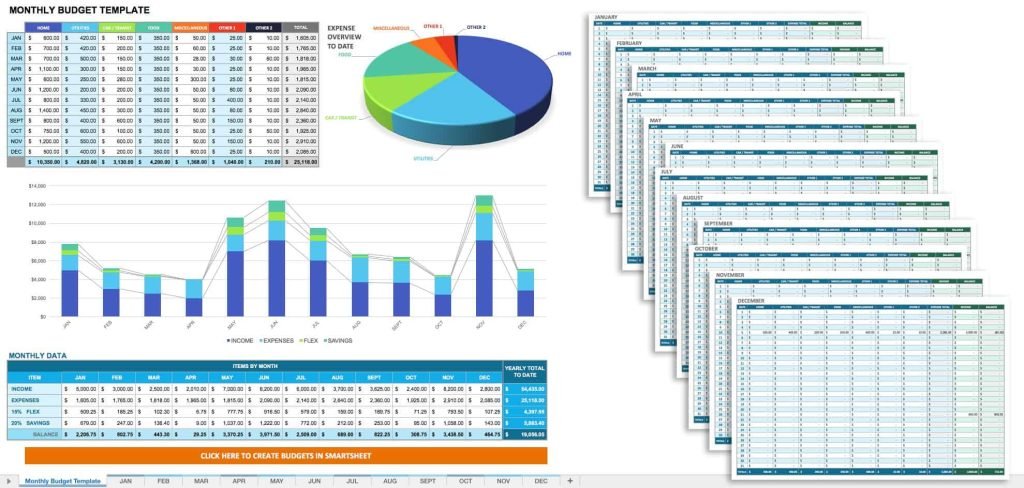

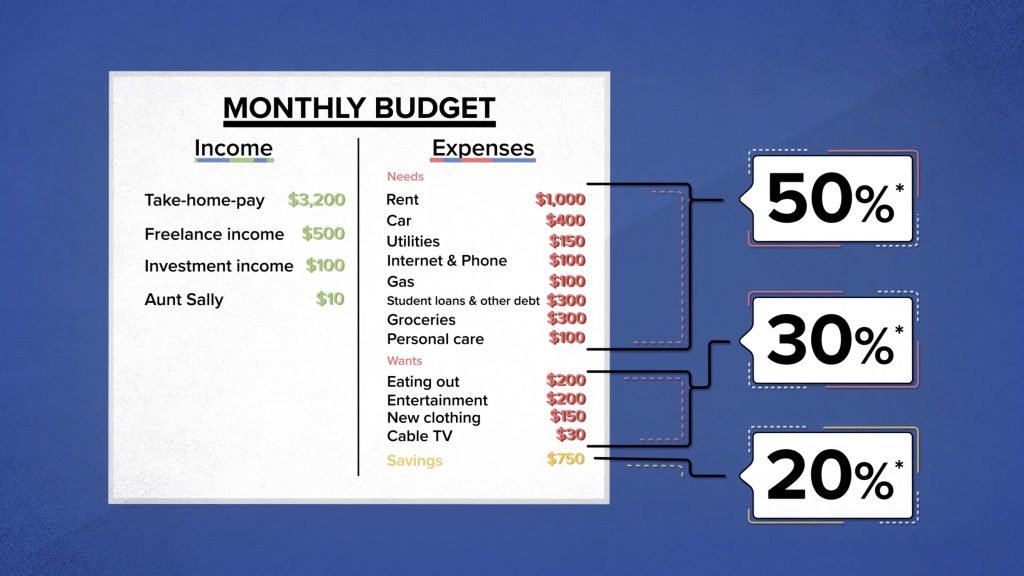

5. Simple Monthly Budget

You may calculate your monthly income and expenses with Excel’s Easy Monthly Budget template. Additionally, it enables you to see the nature of your spending, such as the things you spend the most money on excel templates daily schedule. When making plans for short- or long-term goals, using this free spreadsheet template is the best approach to managing personal finances.

The Summary worksheet gives a comprehensive overview of monthly income, monthly expenses as a whole, and reserves. A dashboard-like appearance is produced by a vertical and horizontal bar chart. On the spreadsheet for reliable revenue and expenses, transaction data can be entered. The primary expense categories are included in the expenses category. According to your demands, you can alter them or add new sections.

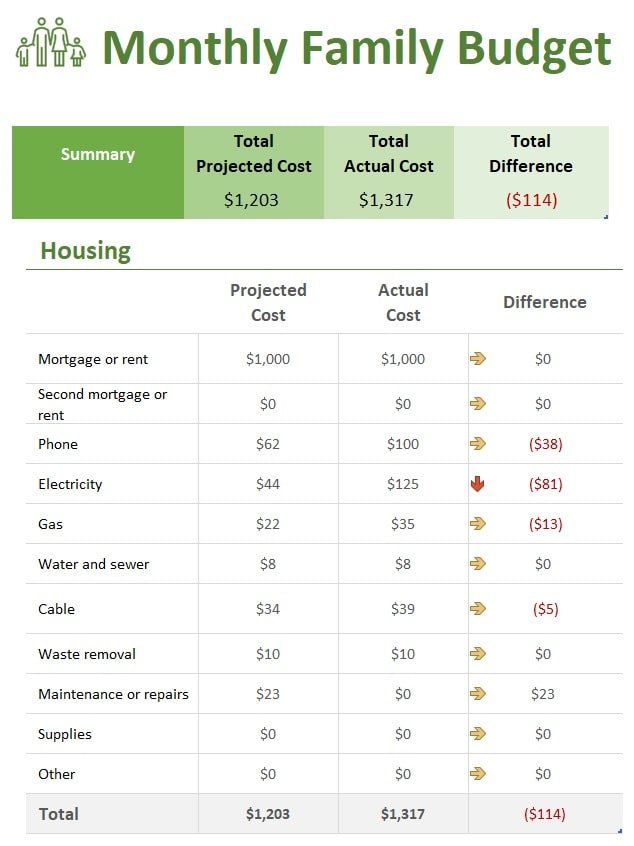

6. Monthly Family Budget

How can I effectively manage my family’s monthly budget using financial Excel templates? You may instantly utilize the free download of the Household monthly budget template In google finance. Access to a view of the account’s balance, earnings, and expenses is provided by its summary pane. You will also get a breakdown of expenses by category beneath the summary dashboard.

Over fifty expense headers are included in the Excel template. There is little chance that you will need to manually include any currency outflow headers because the current list already includes them all. To start keeping track of spending, change the Project tracking excel templates and Actual Cost headings on the Monthly spending spreadsheet.

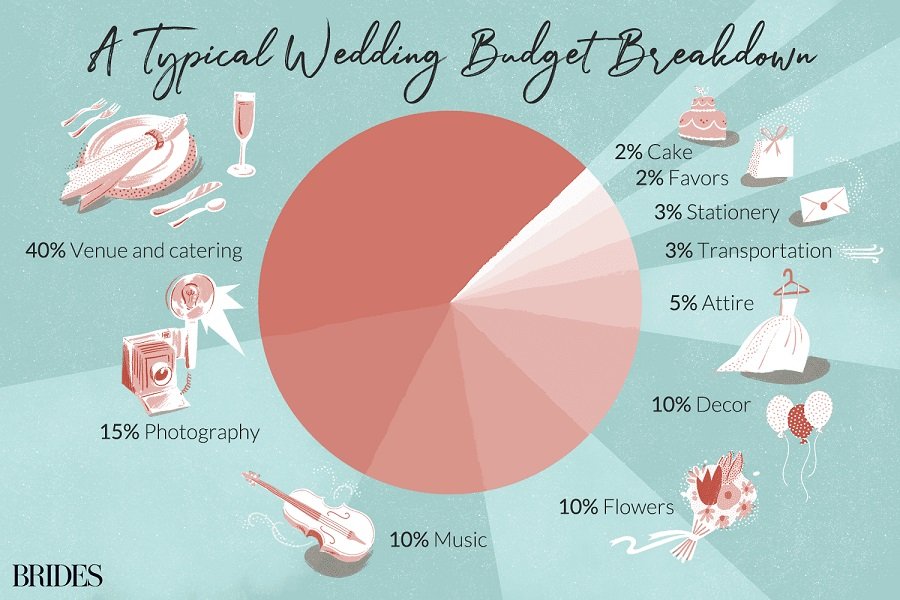

7. Budget for a wedding

Considering that everyone needs to plan their wedding, a simple wedding budget planner should also exist. To see your exact spending, use the Excel wedding budget template. Additionally, you can change the fonts and table colors to fit the expense planner’s wedding motif.

It is a tool for creating budgets that show each cost heading in its window. View the full list of expenses by scrolling down. The tables also show you visually if your wedding budget is being exceeded or maintained. It is the ideal budget Excel template for finances. Read more about the finest online installment loans for weddings.

8. Simple Personal Budget

uncomplicated personal budget You can get a comprehensive summary of your finances using an Excel worksheet. It is the perfect tool for easily tracking monthly expenses and earnings from either job or home. A customized copy can be uploaded to your OneDrive account for easy access from a tablet, computer, or phone.

The one-page breakdown of all your spending and income provided by the template is particularly helpful. To determine annual and monthly totals, formulas are included in the appropriate columns.

For visualizations and analytics, sparklines are shown next to each header for revenue or expenditure. If you want to manage your spending more effectively or save money for a future goal, you may use this template right away.

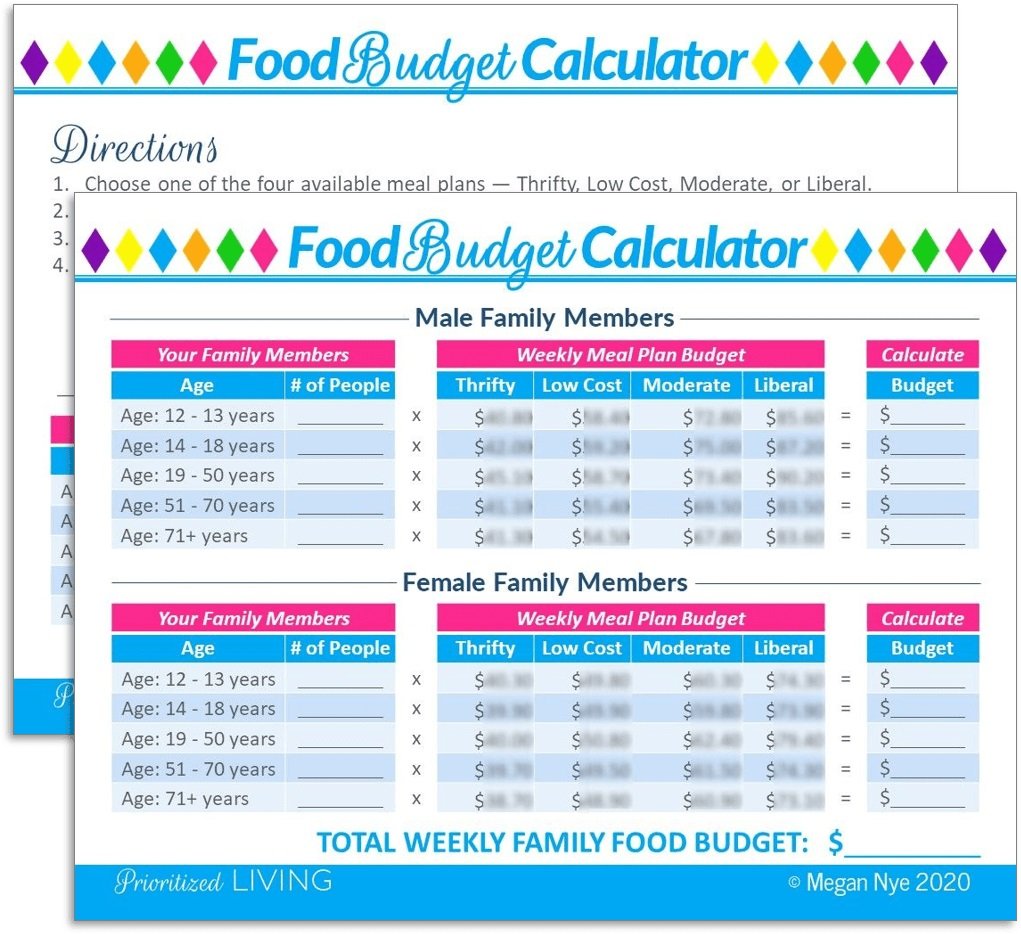

9. Monthly Food Budget

You may need to focus on a certain spending category from time to time, such as your monthly budget for entertainment, food, or purchases. It offers a fine-grained view of particular expenses that commonly go above the budget. For stress-free budgeting, use a monthly food budget.

Make a budget at the beginning of the month. Then, enter your food purchases to keep track of your grocery spending on the costs page. Alternatively, you can change the food expenditure by renaming the text box located below the image header.

10. Project Budget

Handling project finances effectively is the responsibility of the project management excel templates free. In any business, money is the project’s main support system. The manager could risk all of the team’s hard work if he is unable to control expenses effectively.

To achieve this, we advise obtaining the Excel Project Budget template. It has helped hundreds of people complete their dream projects, and it can help you as well as exeter finance. You’ll be able to complete all little and medium in size jobs using this free budget template. It can be utilized for contract work, house improvement, office remodeling, etc.

It shows both the actual costs and the budget that had been planned. It can help you establish whether or not your expenses are within your budget and, if not, how to improve them. All things considered, this is great for quick, less-detailed work. However, you should get the commercial edition of this spreadsheet template if you have larger tasks.

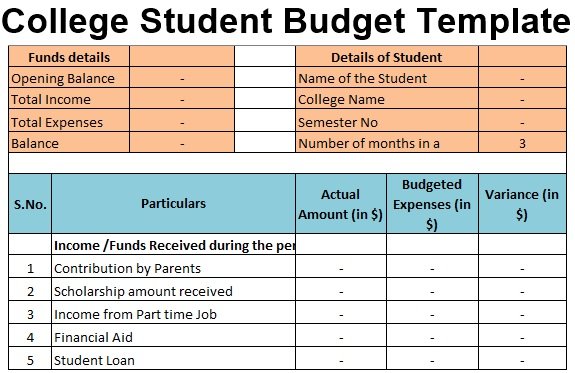

11. College Monthly Budget

It’s crucial to keep track of personal spending while in college because it’s simple to get diverted and spend more than you intended. A free Excel worksheet for use as a desktop application is a monthly college budget. Additionally, you can print it for use in manual budget tracking and upload it to OneDrive for online access.

You may modify this Excel sheet to your child’s needs if you are their parent and they are headed to college. The document can be shared by parents and kids to help everyone comprehend costs. Expense management is simple when transaction amounts are entered into the appropriate fields. The personal budgeting template’s graphs, Sparklines, and stylish sliders make it a fun pastime.

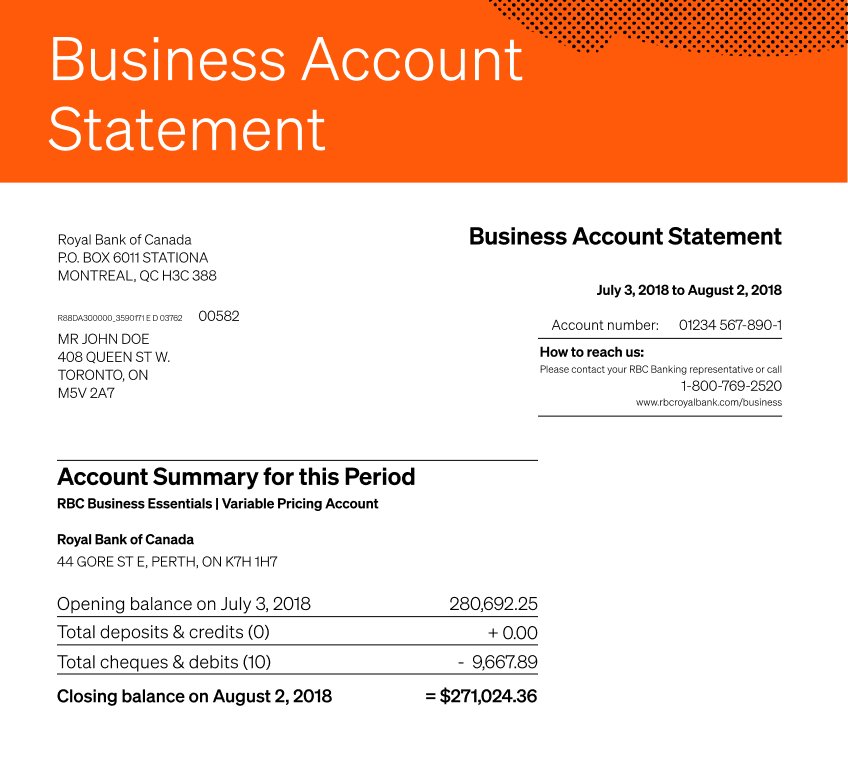

12. Account Statement

You must be fully aware of all your assets and liabilities if you own a business. It’s important to keep track of your money and your debts. It helps you maintain your composure and have a better understanding of your business’s financial health. You won’t be able to make wise choices or investments before that.

Additionally, it will advise you on where to make financial cuts so that you may manage your money well and raise your equity. The Excel Balance Sheet template can be used for this. It has simple concepts that are even easy for a layperson to understand and is quite easy to utilize. Additionally, the template is easily editable, allowing you to make whatever changes you desire.

This template can be used to provide an overview of your world finance. And identify the areas that are contributing to a budget deficit. Your net worth at a given time can be calculated with the help of this balance sheet. It is calculated for you automatically under the owner’s equity section. The common financial ratios are listed at the bottom of the sheet. These consist of the working capital, the debt ratio, and other data.

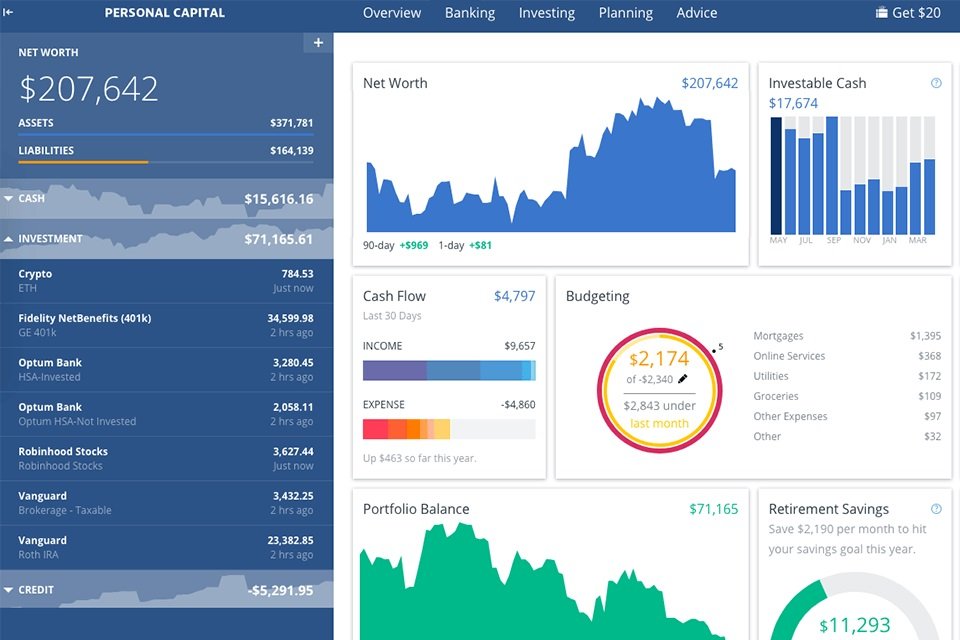

13. Portfolio Monitor

You must have this budget template if you are a shareholder. It will help you actively keep track of your investments and stock options. You can use it to evaluate your equity or to view your dividends and transaction history.

In this situation, the Portfolio Tracker can be of great help. Regardless of whether you decide to be a passive investor or an aggressive trader, bookkeeping is important to understand your financial situation. The Simple Investment Tracker can be utilized for this. You may easily get an idea of your entire cost of accounts from it. You may compare it to previous performance and it also shows the gain or loss based on the market value.

You can also determine whether you are making a sufficient profit by comparing your average entry price to your current costs. Additionally, it provides mariner finance an easy way to understand the difference between investment value and market value.

This budget template provides in-depth information about your investment accounts. It is made for those who wish to evaluate their investments and profits immediately. It solely shows the details of your investment and its current value. The fact that it skips over some details is a drawback. Due to the need for descriptions in some places, this can be challenging to understand. It’s great for tracking your investments aside from that.

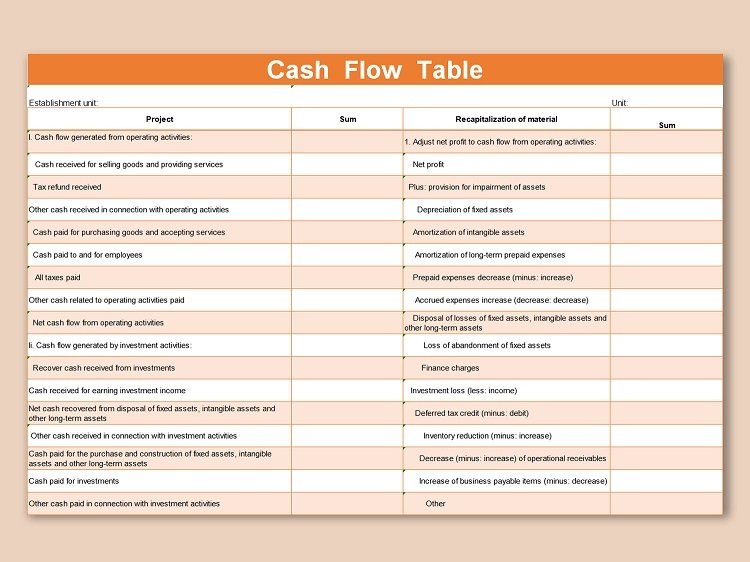

14. Cash Flow Tracker

A cash flow tracker does exactly what its name implies—helps you keep track of your cash flows. The terms “cashflow” and “outflow” are used to denote the inflow and outflow of money, alternately. Regardless matter whether you are an individual or a business, having a cash flow tracker is essential. It can help identify expenses, operating expenses, business receivables, and more.

It may have a significant impact on your planning and business decisions. You must cut down on your expenses and improvise if your outflow is more than your intake. This can help you assess whether your pace is appropriate for impending project work. And take prompt action to make improvements.

You may customize the spreadsheet in anyway you like, and it is easy to understand. Making your money-tracking experience easier is facilitated by all of this. The objective is to bring in the most inflows and help run all activities smoothly.

Frequently asked questions

Q: Is there a budget template in Excel?

Ans: Yes, there are numerous budget templates in Excel. Excel has everything, including personal budgets, project budgets, and family budget planners.

Final Thoughts:

Your budgeting requirements should be met by utilizing these free Excel templates. You can pick any free Excel template and start saving money based on the situation, such as a family budget, food budget, or child’s college spending.